Redesigning the experience of transferring abroad

A redesign focused on understanding why users dropped off during the international transfer flow. Through research and behavioral insights, we restructured the funnel and streamlined key steps, reducing friction and successfully improving user retention.

1. Context

The redesign of the international transfer functionality arose from the need to include the intermediary bank option, streamlining the process for users. After analyzing the data, we identified transaction leaks, which indicated friction in the current experience. Therefore, we not only added the new functionality but also improved the entire flow, facilitating a clearer, more efficient, and more secure experience for users.

2. My Contribution

As the assigned product designer, I was in charge of thoroughly investigating how users felt about the current product and other products on the market, proposing design improvements, and validating the ideas designed. I also documented the physical process of an international transfer and the actors involved. Finally, I was in charge of following up with the development team and documenting the final design.

3. Research

1

The requested fields are too long. This causes the user to delay or not complete the information completely.

2

Not knowing when the transfer will arrive abroad causes doubts and uncertainty among users.

3

There is confusing information about commissions. Users are unsure how commissions work.

Goal

Design a clear and efficient international transfer experience, optimizing conversion with intermediary bank integration.

Natural user

Makes occasional transfers to their close circle or for studies.

Business

Makes frequent payments to suppliers or partners in other countries.

Two rounds of testing were carried out to observe:

4. Solution

Decision 1

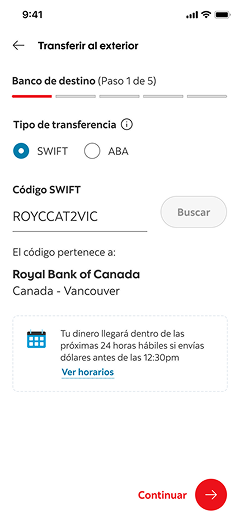

An A/B test was conducted. We chose this first screen as part of the final design. Reasons -> (1) It allows the user to copy and paste the SWIFT code. (2) The user can immediately correct their mistakes. The response can be quickly viewed. (3) It instructs the user what types of transfers are available. (4) It notifies the user when their transfer will arrive on the first screen.

Decision 2

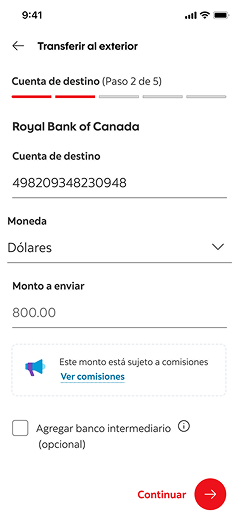

We added the intermediary bank within the destination account section. This decision was made by benchmarking similar experiences in Peru and by conducting card sorting with users.

Decision 3

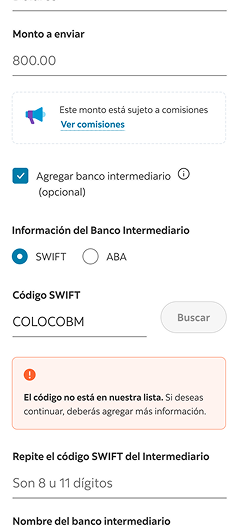

If the bank's SWIFT code could not be found, it was decided to allow the user to continue, warning them that the code was not in our database and that they must enter additional information to continue. This choice was made based on conversations with customers about their past experiences making transfers.

Decision 4

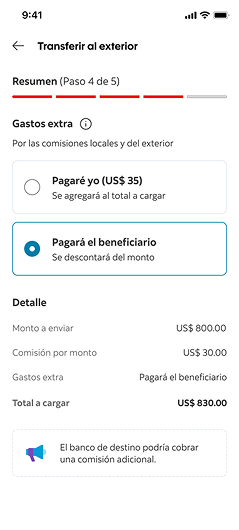

We avoided using technical terms in the name of the fee and instead used terms that refer to the type of expense users would incur. Furthermore, during testing, it was observed that users prefer to review a summary of the total amount they intend to transfer.

5. Learnings

Working on international transfers was challenging due to the technical terminology and the complexity of the ecosystem, which operates almost like a "black box" when multiple banks are involved. It also required aligning with teams from different areas, where we didn't always share the same financial language. However, this process allowed me to better understand the flow, improve my communication with specialized teams and strengthen my problem-solving skills in complex environments.